Backstage & Influences

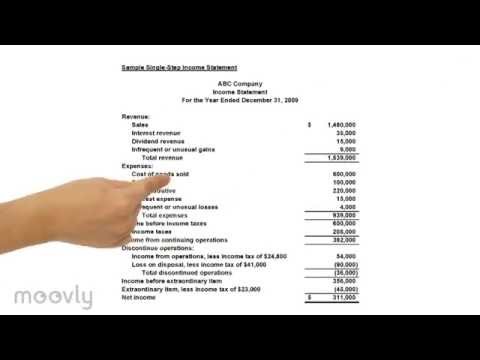

How often are you looking at your total current income and total current expenses? Leveraging bookkeeping services allows you to look at your income and expenses in real-time frequently. Having access to robust reports and financial statements allows you to make better decisions for your business leading to an increased ROI from investing in online bookkeeping services. Bookkeeping services can also help small business owners save more through tax preparation and tax filing. When your business is still growing, bookkeeping how to hire the right bookkeeper for your small business bench accounting isn’t such a cumbersome task.

Because every client and their needs vary so widely, we provide flexible, unique pricing for every client. Get in touch with one of our specialists today to get your quote or click here to get started. The benefit of using a virtual bookkeeper as a business owner is that it is often cheaper than hiring someone local to work on-site. The bookkeeper can be paid as a contractor and work as little or as much as the business needs. For a bookkeeper, working virtually provides convenience in the form of schedule flexibility and the ability to work from home. We believe everyone should be able to make financial decisions with confidence.

Trusted experts. Added peace of mind.

That’s because it offers a prerevenue discount of $200 per month. Each plan comes with a finance expert, automated transaction imports, P&L, balance sheet and cash flow statements. You’ll also get burn rate calculations, which is helpful for startups that need to closely track their spending.

Our in-house team is also supported by machine learning technology, which allows us to automatically process large amounts of financial data instantly, and close your books faster and accurately. The Bench platform gives you monthly financial statements and expense overviews to keep you in control of your money. At-a-glance visual reports help you see the big picture and give you actionable insights to help you grow your business. Although InDinero offers scalable plans, they’re not very transparent about what exactly they include in each plan until you talk to a salesperson. Unfortunately, InDinero doesn’t have many integration options, but if you already use the software they integrate with, it’s a very robust solution. Bookkeeping is an unavoidable part of having a business because the IRS has certain rules around financial recordkeeping.

Expert Analysis

Live Expert Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable. The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. QuickBooks Online offers Expert Full Service Payroll for an additional cost.

Do small businesses need bookkeeping?

You’re limited to one scheduled appointment at a time and appointments have to work within your bookkeeper’s schedule. Communications that are available any time include document sharing and live chat with a member state payroll services forms of your bookkeeper’s extended team. Your team of bookkeeping experts review your transactions and prepare financial statements every month. Bench offers a free trial for each plan that includes one prior month of bookkeeping, and whether you choose to continue using Bench or not, you get to keep the income statement and balance sheet for that month. In the cleanup/setup phase, your bookkeeper helps you set up your chart of accounts, connects your banks, and teaches you the basics of QuickBooks.

Next, your bookkeeper will take on the monthly management of your books. Get updates, set up video calls, or send questions via messages. First, a bookkeeper reviews your chart of accounts and past transactions to bring your books up to date. With QuickBooks Live Expert Full-Service Bookkeeping, a dedicated bookkeeper will get to know your business, bring your past books up to date, and do your book for you, start to finish. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct. If you need to share files with your bookkeeping team, it’s as simple as uploading a file.

Frequently asked questions

- Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services.

- While there are certain scenarios where it makes sense to have a dedicated bookkeeper (or several) on your staff, this is typically reserved for very large companies.

- This way you don’t have to rely on the claims they make about what they can do for you.

- Your team of bookkeeping experts review your transactions and prepare financial statements every month.

- She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University.

- Ask your prospective virtual bookkeeping service if they have experience in your industry, and if so, how many clients they have in your industry.

If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you. The cost of bookkeeping services can vary depending on the size of your business and the features you need. Some bookkeeping services charge a monthly fee while others charge by the hour. You can find services for as little as $20 per month while others run thousands per month. rent expense: accountingtools Your bookkeeper gets to know your business and provides ongoing bookkeeping services.

Next Post : Polskie Kasyno

-

Search