Backstage & Influences

As mentioned, petty cash can make things nice and convenient but does carry certain risks. If you follow some best practices, you can reduce the risks that come with petty cash, and protect yourself and your employees. Keeping a small amount of cash in your office or at your store makes it much easier for office managers, bookkeepers, and supervisors to cover occasional small purchases or expenses. For example, when you sell $100 worth of merchandise to customer « a », debit sales for $100 and credit cash for $100.

How do you record in a cash journal?

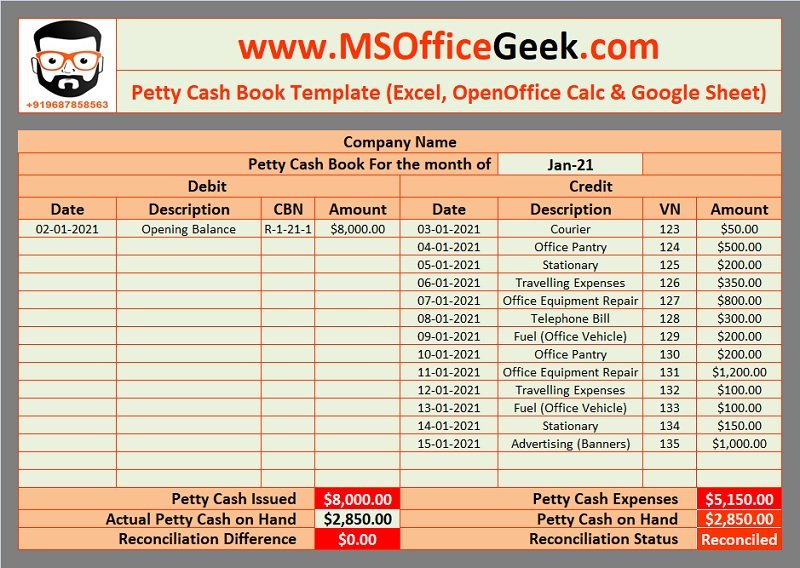

Notice how the far right-hand row lists the current balance of the petty cash fund? This lets you reconcile—that’s fancy accounting speak for “double check”—your petty cash fund on the fly. However, a petty cash book maintains all balances that can be subsequently double-checked if there is a need to do so. It includes balances and transactions, which, if otherwise individually managed, might be harder to keep track of. Hence, all such transactions are booked under the petty cash account.

- A petty cash book is just as its name suggests a book which is used for the purpose of recording small amounts of expenses in a business.

- The reconciliation and review process help organizations safeguard against any leakages because it is often harder to keep track of these expenses.

- Cash is hard to secure and impossible to track; it’s very easy for bills to disappear without a trace—even if you’ve established a careful system of receipts or vouchers.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Clearly communicate security procedures to the petty cash custodian and relevant staff members.

How To Do Petty Cash Accounting Using QuickBooks Online

In his article for the Institute of Internal Auditors, bank auditor Umair Danka notes that there’s a significant risk of petty cash being spent on non-business activities. To combat this, make sure your employees understand upfront what petty cash can and can’t be spent on. Finally, surprise petty cash counts should be made to maintain good internal control over the fund. The custodian of the petty cash fund is in charge of approving and making all disbursements from the fund.

Take control of your petty cash with our expense management solution

The petty cashier then encashes the cheque and keeps this money in a box termed a petty cash box. The petty cash fund is always created for a definite amount of money. This means any change in the petty cash fund does not require a new journal entry. The most effective way to record petty cash payments analytical petty cash book is the most effective way to record petty cash payments. Additionally, the money received from the head cashier is written on the debit money column. At the same time, the credit side will contain money columns as per the expenses, which will be arranged chronologically.

And the amount of cash you have in your storage box or drawer should be the same as the current balance of the account. The reconciliation and review process help organizations safeguard against any leakages because it is often harder to keep track of these expenses. We can use the voucher with a sequential number as the supporting reference. The cashier can use it as the template to complete some basic information and signature of the requested person. The petty cashier of John and James Company paid cash for the following expenditures during March 2018. When the petty cashier spends the amount, he or she submits the account to the head cashier for approval.

Having paper documents and receipts for petty expenses might sound negligible; however, with these, you can always tally up the amount that was allotted and the expenses that were made. Automated systems facilitate the reconciliation of petty cash transactions, reducing manual effort and minimizing the chances of discrepancies. Additionally, the reimbursement workflow can be automated, streamlining the approval and reimbursement cycle, thus ensuring a smooth flow of funds back into the petty cash system. Implement advanced security measures to safeguard digital petty cash transactions. This includes robust encryption protocols, secure access controls, and multi-factor authentication, fortifying the system against potential fraudulent activities and unauthorized access.

To use petty cash, simply grab however much cash you need from the lockbox (say, $10). That depends on how many small expenses you make and how often you make them, but most businesses seem fine carrying between $100 and $200 in petty cash. The reconciliation process ensures that the fund’s remaining balance equals the difference between the original balance minus charges detailed on receipts and invoices. If the remaining balance is less than what it should be, there is a shortage. If the remaining balance is more than what it should be, there is an overage.

Part of the manual record-keeping system of a firm, in most companies, a petty cash book is a ledger book instead of a computer record. This is different from bookkeeping which is the process of recording your company’s financial transactions into organized accounts. The Cash Over and Short account will be used to balance the entry when the cash needed to get back to the petty cash account does not match the total of petty cash vouchers.

These headers are present for both the left side showing receipts and the right side showing payments. There are three petty cash maintenance systems — Open system, Fixed system, and Imprest system. An all-in-one spend management platform designed to make what is the purpose of an invoice financial management a piece of cake for all businesses. These regular audits will help to avoid any errors or loopholes in the system. Along with the regular ones, the head accountant or financial manager must sometimes call for surprise checks as well.

All business expenses are equally important and must be tracked to maintain a steady cash flow and not go overboard, which damages the baseline. So, petty expenses are also one of the business spending categories, and this also has to be managed properly. Notice that the appropriate expense accounts are debited and that cash is credited. There is no need to make an entry to the petty cash account because it still shows a balance of $100. Instead of processing numerous small transactions individually, businesses can record petty cash replenishments as a single entry, streamlining bookkeeping.

If the numbers don’t match, that means something went wrong, and you need to review each expense for any discrepancies. This is the first entry in your petty cash account, represented by the following journal entry that shows petty cash leaving your bank account. The petty cash custodian is in charge of managing the petty cash fund. For slightly larger small businesses, this might be your office administrator. Under this system, a lump sum amount of cash is given to the petty cashier.

-

Search