Backstage & Influences

Xero Pricing, Features, Reviews & Comparison of Alternatives

Xero has been moving to new servers which has been mostly uneventful. We have had some invoices that Xero sends bounce because they were considered spam.

If you need to reorder inventory, you can use the software to create and send purchase orders. You can then convert the purchase order to bills for payment or invoices for your customers. For complex inventory needs, such as if you stock more than 4,000 items, advanced inventory integrations are available through the app marketplace. Automatic payment reminders encourage customers to pay on time, saving you from having to follow up on outstanding invoices manually.

Xero overview

However, it’s worth noting that Wave’s free accounting app doesn’t include payroll services. Small-business owners can add self-service payroll for $20 per month, plus $4 per employee or contractor. In some states, you can also choose full-service payroll for $35 per month, plus the $4 monthly charge for every employee and contractor. Users get unlimited invoicing for an unlimited number of vendors and customers. You can track your income and expenses, scan receipts with your iPhone or Android phone, connect your bank accounts, create financial reports, and more.

When you add in the company’s cloud-based solution, you get an ideal accounting software app for businesses that use Macs. No business should have to accept and deal with impaired software functionality because it uses one type of operating system versus another OS. Consider AccountEdge Pro if you’re looking for a subscription-free small-business accounting solution. This full-service, double-entry accounting software includes invoices, payments, purchases, payroll, and inventory.

The time it would take me to complete the data entry I would need to each month outweighs the investment in Xero. Hiring a bookkeeper to enter the receipts into a spreadsheet, well that would just be madness. QuickBooks Online has been in the market for longer than Xero, is very well-developed, and is generally loved by accountants – especially in the U.S. market, which QBO have dominated.

Long story short, I wound up with all sorts of fines (hundreds of dollars) and Xero refuses to take any responsibility. The reintegration failed because Xero’s API site is unreachable. I switched over from QB online based on the recommendation of my x-bookkeeper.

I have over 40 clients and some on it as longs as 4 years and i can honestly say I havn’t come across a problem yet. It is all cloud based so you can access it anywhere and on any machine/ipad. They even offer the practice the software completely free and I have just started to lodge all my BAS directly from Xero so no need to even log into the ATO portal. I can honestly say this is the program of the future and with so many apps that can feed into this software it will become more and more prominent in the bookkeeping market.

Xero has never offered phone support and has relied on email support. Users have complained about the lack of phone support forever, but this wasn’t much of a problem before, as Xero usually answered emails within an hour or two. Now, it can take up to a day to hear back from a representative.

Timesaving Features

- NetSuite is ideal for enterprises in need of a cloud-based ERP solution with advanced features, strong reporting, and numerous integrations.

- QuickBooks’ best feature is its ease of use—the interface requires next to no learning curve, and the mobile app makes on-the-go payroll easier.

- The company’s customer service and mobile apps leave something to be desired, but Xero still receives a large number of positive customer reviews.

- You can contact the company for support via email or live chat (phone support is not available).

- And although you have to pay for payroll software, the return on your investment is worth it.

- Xero will convert QuickBooks and Sage data for free when users sign up for a new account.

If you need some extra assistance in finding features or understanding the software, Xero also offers a help center. We also have a comprehensive and free How To Set Up Your Xero Account guide that teaches you how to use and optimize your Xero account. While the software is well-organized, it does have a steep learning curve (not as steep as QuickBooks, but it is more difficult to learn than other cloud-based options). It takes quite a while to explore all of the features it has to offer, but once you get acquainted with the software, Xero is fairly easy to use. As we mentioned earlier, Xero no longer includes payroll in its monthly subscriptions.

Xero can save you time and simplify accounting by automating tasks. Xero comes with 24/7 email and live chat support and outbound phone assistance at no extra cost. Should you run into a problem, you can call the company to receive help fast and free of charge. That’s ideal for small business owners who need advice instantaneously.

We also added Zoho Books to our top five recommendations thanks to its comprehensive features, helpful automation services, and easy integration with customer relationship management software. I doing accounting for small businesses & startups, and I heard nothing but great reviews on Xero, so I switched xero log in one of my clients over to Xero. Many simple things (like doing a journal entry to cash) is not allowed. When I spoke with a representative, I was told “there should be no reason to create a JE to cash.” This is typically true, but there are times when I need to and it makes my life a lot easier.

Xero support was reasonably fast but wouldn’t even acknowledge that they could be at fault. From your wording (“your big server move”), it sounds like you think this site is a part of Xero; it isn’t.

There is a tiny amount more friction from Xero, and the bank feed connection is slightly less seamless than with QBO. Log in to Xero any time, anywhere, on any device, to make pay runs a walk in the park. Xero Payroll makes managing staff stress free and helps employers stay compliant.

Other features of Xero include quick bank reconciliation, expense management and inventory management. Not all small businesses need the extra features and support that paid accounting services provide. Wave Financial offers free, cloud-based accounting software specifically designed for small businesses. With Kashoo software, you can create and send invoices, track your expenses, set up credit card payments, and generate basic financial reports.

Both plans include all the aforementioned, but the Premium plan also includes white labelling, subcontracting, and the option to add additional users to your account. Zoho Books is part of the Zoho suite of services—which includes over 40 different business apps, including a CRM, HR tools, and reporting options. As a web-based platform, Zoho Books allows you to access your account wherever you have internet, as well as use their mobile accounting app for either iOS or Android. But, to access the potential of Wave, you’ll need to pay extra. Features like sending and receiving payments and running payroll cost extra.

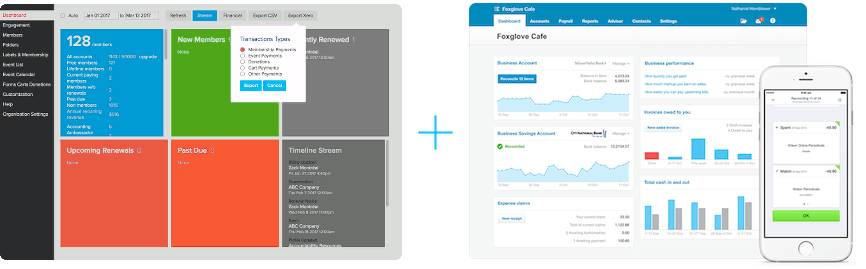

Well, Xero has a unique dashboard display feature, which allows business owners to clearly see how much money is going out and coming in. The Dashboard display provides quick links to the most important parts of your accounts and also gives you a snapshot of your overall expenses, creditors and debtors, https://www.bookstime.com/articles/xero and bank balances. And this allows for the easy tracking of payments, and reconciliation of bookkeeping errors. The right accounting software for small business can make your life easier. It can save you time and money, and it’s a lot more efficient than manual bookkeeping and spreadsheets.

You’ve missed the best solution for small to medium businesses in Australia – Quickbooks Online. It does everything Xero does and more, at a fraction of the price. Though its connection to the old Quickbooks can be seen in some of the terminology, its is nothing like that awful, clunky software. As of the time of writing, both Xero and QuickBooks Online are rated 4/5 for customer service on Capterra and 3.9/5 on GetApp.

To further inform our decisions, we contacted each vendor to measure the quality of its customer support. We began our research by asking business owners which accounting software program they use, what they love about it and what they think makes it the « perfect » application. We also researched popular accounting software apps that frequently appear on reputable review websites, top lists and business websites. Also, whether or not you outsource your bookkeeping, industry experts recommend working with an accountant for business analysis and strategic advice that can help your businesses grow. If you use a free accounting software app, there’s an assumption that you’re using a lesser product.

However, if you’re looking for a simple accounting tool at no cost, you can’t get much better than Wave. QuickBooks Self Employed does not include a balance sheet, nor does it currently allow you to upgrade to a more robust QuickBooks product. It does, however, allow accountant collaboration, and at $15/month—even less with the discount—it costs much less than the other QuickBooks Online options. Need more features than those offered in the $10 per month version? You can choose Sage Accounting for $25 per month to unlock unlimited collaboration, quotes and estimates, vendor bill tracking, cash flow forecasts, and the option to choose either cash or accrual basis accounting.

-

Search