Backstage & Influences

Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts, or the inventory obsolescence reserve. Notice that the ending balance in the asset Accounts https://www.bing.com/search?q=%D0%BA%D1%80%D0%B8%D0%BF%D1%82%D0%BE+%D0%B1%D0%B8%D1%80%D0%B6%D0%B0&qs=n&form=QBRE&sp=-1&pq=%D0%BA%D1%80%D0%B8%D0%BF%D1%82%D0%BE+%D0%B1%D0%B8%D1%80%D0%B6%D0%B0&sc=1-12&sk=&cvid=B525840338194CB6B234B0FD04807C17 Receivable is now $7,600—the correct amount that the company has a right to receive. The balance in Service Revenues will increase during the year as the account is credited whenever a sales invoice is prepared.

Adjusting journal entry for notes payable will discuss options for setting up a system for recording notes payable in an https://ru.investing.com/brokers/cryptocurrency-brokers accounting system. Adjusting entries are entries made at the end of an accounting period, at the end of a month or year.

Why make adjusting entries?

The balance in the asset Supplies at the end of the accounting year will carry over to the next accounting year. Under the accrual method of accounting, a business is to report all of the revenues (and related receivables) https://personal-accounting.org/what-should-you-make-a-mistaken-money-transfer/ that it has earned during an accounting period. A business may have earned fees from having provided services to clients, but the accounting records do not yet contain the revenues or the receivables.

The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31. When you record an accrual, deferral, https://personal-accounting.org/ or estimate journal entry, it usually impacts an asset or liability account. For example, if you accrue an expense, this also increases a liability account.

When entering payments for an installment not we have some options to make the system easier. To keep the loan balance correct at all times we should record interest and principal portions of each payment, but this requires a different journal entry each payment. The adjusting entry can then be used to adjust the loan and the interest expense to the proper amount. Since the firm is set to release its year-end financial statements in January, an adjusting entry is needed to reflect the accrued interest expense for December.

Does adjusting entries affect cash?

If the adjusting entry is not made, assets, owner’s equity, and net income will be overstated, and expenses will be understated. While most expenses are prepaid, a few are paid after a service has been performed. The adjusting entry requires a debit to an expense account and a credit to a liability account.

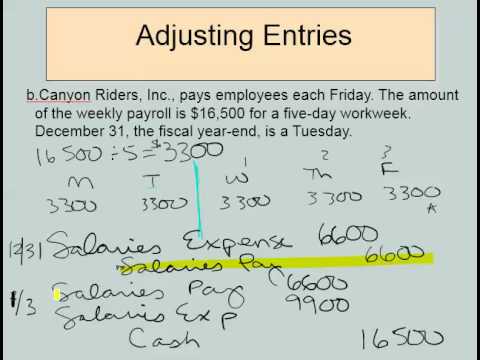

Adjusting Entries

- Finally, depreciation is not intended to reduce the cost of a fixed asset to its market value.

- In this example, debit $300 to the interest expense account and credit $300 to interest payable.

- Even though you’re paid now, you need to make sure the revenue is recorded in the month you perform the service and actually incur the prepaid expenses.

- Depreciation and a number of other accounting tasks make it inefficient for the accounting department to properly track and account for fixed assets.

- AccountDebitCreditCash$150Accounts Receivable$150To fix the entries, find the difference between the correct amount and the mistaken entry.

Notice that the ending balance in the asset Supplies is now $725—the correct amount of supplies that the company actually has on hand. The income statement account Supplies Expense has been increased by the $375 adjusting entry. It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. The balance in Supplies Expense will increase during the year as the account is debited. Supplies Expense will start the next accounting year with a zero balance.

Prepaid Expenses

Or, if you defer revenue recognition to a later period, this also increases a liability account. Thus, adjusting entries impact the balance sheet, not just the income statement. Accumulated Depreciation – Equipment is a contra asset account and its preliminary balance of $7,500 is the amount of depreciation actually entered into the account since the Equipment was acquired.

Journalizing & Posting Adjusting Entries from Worksheet

The balance in Accounts Receivable also increases if the sale was on credit (as opposed to a cash sale). However, Accounts Receivable will decrease whenever a customer pays some of the amount Accounts Receivable Turnover Ratio owed to the company. Therefore the balance in Accounts Receivable might be approximately the amount of one month’s sales, if the company allows customers to pay their invoices in 30 days.

Are adjusting entries optional?

An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period.

Unearned Revenue

The correct balance should be the cumulative amount of depreciation from the time that the equipment was acquired through the date of the balance sheet. A review indicates that as of December 31 the accumulated amount of depreciation should be $9,000. Therefore the account Accumulated https://www.youtube.com/results?search_query=forex+crm Depreciation – Equipment will need to have an ending balance of $9,000. This will require an additional $1,500 credit to this account. The income statement account that is pertinent to this adjusting entry and which will be debited for $1,500 is Depreciation Expense – Equipment.

Next Post : Что такое скрам — инструкция для новичков — Netpeak Blog

-

Search